In recent financial disclosures, AMD demonstrates impressive resilience and growth, solidifying its position in the competitive landscape of semiconductors. Achieving a revenue of $7.7 billion—an eye-popping 32% increase year-over-year—reflects a company firing on all cylinders. The surge is primarily driven by skyrocketing demand for Ryzen processors and Radeon graphics cards, which have captivated gamers, PC builders, and enterprise clients alike. AMD’s ability to capitalize on this momentum showcases its strategic agility and market acceptance, positioning it as a formidable contender against established giants like Intel and Nvidia.

However, this positive narrative is somewhat complicated by recent setbacks, notably in its data center segment. Export restrictions on AI processors, particularly the MI308 GPUs bound for China, have resulted in significant inventory and related financial charges—approximately $800 million—leading to an operating loss within an otherwise profitable division. While overall revenue for the data center remains robust at $3.2 billion—up 14% from the previous year—the unexpected losses highlight vulnerabilities in AMD’s supply chain and geopolitical risks that could future-proof its expansion plans. This dichotomy underscores the importance of strategic diversification and geopolitical awareness in sustaining long-term growth.

Market Dynamics and Competitive Edges

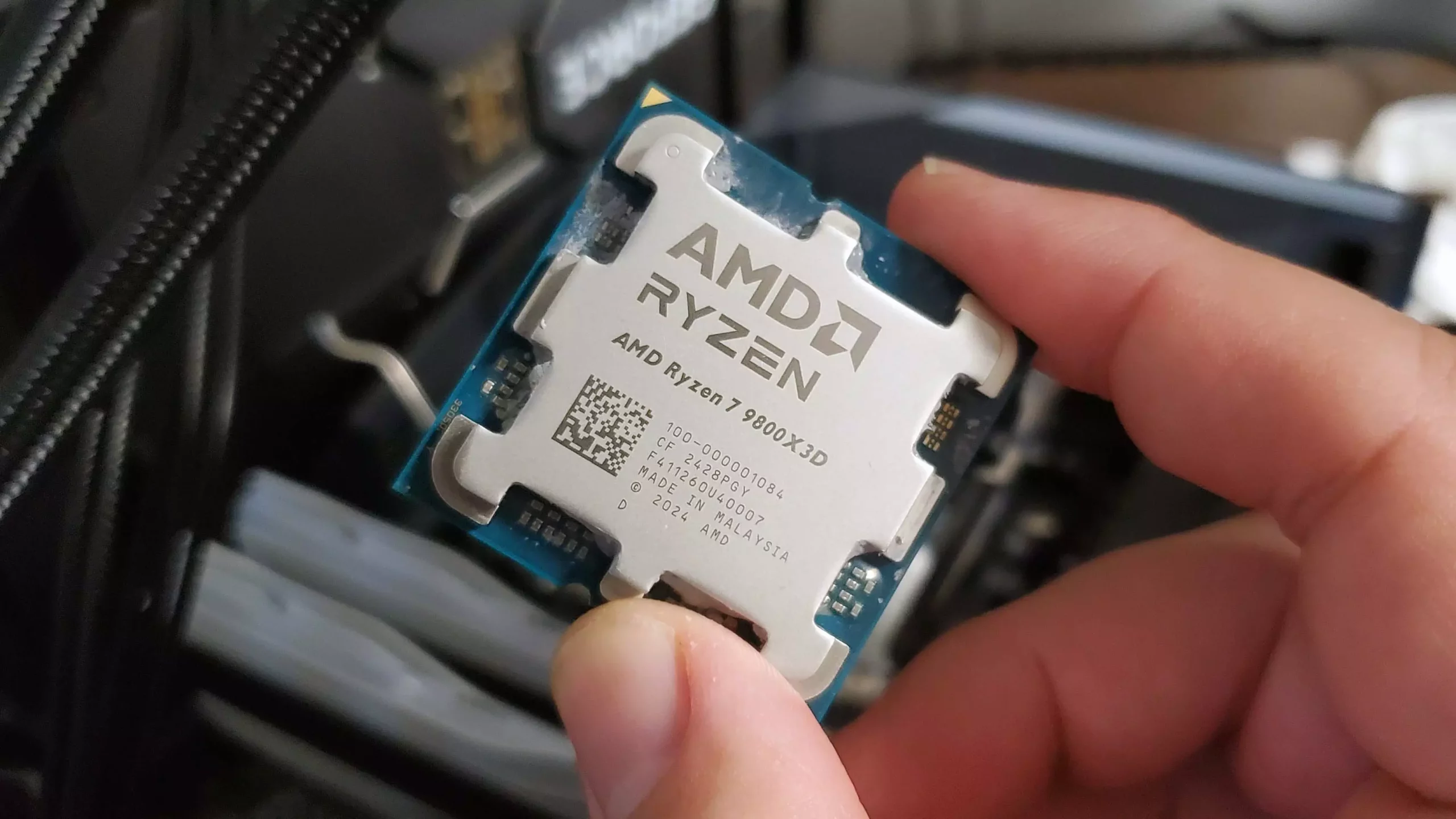

The Client and Gaming divisions form the core of AMD’s recent triumphs, with a combined revenue of nearly $3.7 billion. These sectors experienced an astounding 73% year-over-year increase, propelled by innovative product offerings like the Ryzen 7 9800X3D CPUs and Radeon RX 9070 XT graphics cards. AMD’s aggressive push into gaming hardware, coupled with a notable increase in OEM licensing—particularly with Dell—has amplified its market share. The decline of Intel’s dominance due to missteps with Raptor Lake and the tepid response to Arrow Lake has created a rare opening for AMD to shift the narrative in its favor.

Furthermore, AMD’s strategic embrace of semi-custom chips has unlocked lucrative opportunities in the console and OEM markets. The company’s flexible chiplet architecture allows it to tailor solutions for various clients, enabling rapid adaptation to market demands. Unlike Nvidia, which dominates high-performance data center revenue, AMD’s relatively modest gains indicate a potential for future expansion. Its focus on innovation and strategic partnerships could accelerate its ascent, provided geopolitical hurdles are managed effectively.

Challenges and Opportunities on the Horizon

Despite bullish forecasts predicting $8.6 billion in revenue for Q3, AMD remains circumspect about its future trajectory. The US export restrictions on high-end AI GPUs symbolize the fragility of its global supply chain and the geopolitical landscape it must navigate. The inventory write-offs, while troubling in the short term, might be viewed in a broader context as a temporary resistance before a renewed push into key markets.

Potential pathways for growth include the resumption of AI chip sales to China, which could significantly boost revenue streams. If AMD can negotiate its way past regulatory roadblocks, the economic upside is substantial—especially as artificial intelligence and data center applications continue to evolve rapidly. Additionally, the company’s focus on energy-efficient, high-performance chips positions it favorably as potential demands for greener data centers and cloud services intensify globally.

It’s also crucial for AMD to continue expanding its presence beyond traditional markets. The recent boom in consumer hardware demand showcases its ability to capitalize on trends, but diversification into enterprise and cloud services will be essential to sustain long-term growth. As competitors grapple with their own strategic missteps, AMD’s proactive approach in innovation and market engagement exemplifies a company eager not just to survive, but to thrive amidst adversity.

In essence, AMD stands at a pivotal juncture—leveraging recent successes while confronting geopolitical and market headwinds with strategic resolve. Its ability to turn challenges into opportunities will ultimately define its trajectory as a leader in the rapidly evolving world of semiconductors and computing infrastructure.