As Intel asserts its readiness to launch the new 18A chip production node, the industry is abuzz with speculation about what this means for the future of computing. This new landing page on Intel’s website heralds its pivotal node as a hallmark of innovation, yet a deeper dive into the implications reveals a complex tapestry of potential and skepticism surrounding Intel’s roadmap for the new chips.

While the arrival of Intel’s 18A node heralds fresh advancements in chip technology, the focus appears not only on internal solutions but also prominently targets potential customers for its burgeoning foundry services. The planned Panther Lake laptop chip, anticipated for volume production by late 2025, serves as one of the flagship products leveraging this new node, yet it will not find its way into consumer devices until early 2026. This timeline raises questions about Intel’s dual focus—are they motivating investors and manufacturers equally, or is the narrative more a matter of public relations effort considering their lagging competition?

Intel’s decision to publicly declare the 18A node as “ready” seems strategically timed as it prepares for customer projects, with initial tape-outs expected in the first half of 2025. However, skepticism arises when considering that Intel’s own chips, such as the Clearwater Forest CPU, have faced delays, now slated for the first half of 2026. Such postponements could signal larger issues within Intel’s production capabilities, thereby tarnishing the credibility of its claims regarding the readiness of the 18A node.

The announcement of Intel 18A is part of a comprehensive strategy dubbed “five nodes in four years,” which set up ambitious expectations from its inception in mid-2021. While the initiative was marked by notable advances through Intel 7 and Intel 4, the reality is less glamorous when the definitions of “new” are scrutinized. Intel 7 represents a minor upgrade along the long-standing 10nm technology, and Intel 4, despite being branded anew, resembles a reworked 7nm process.

The situation becomes even muddled as one examines the characteristics of subsequent nodes. Each step looks less like a leap forward and more like iterations on existing technologies. Thus, despite declaring 18A as a triumphant launch, Intel’s history with earlier nodes raises valid doubts on whether these innovations will manifest in meaningful competition against other industrial players like TSMC.

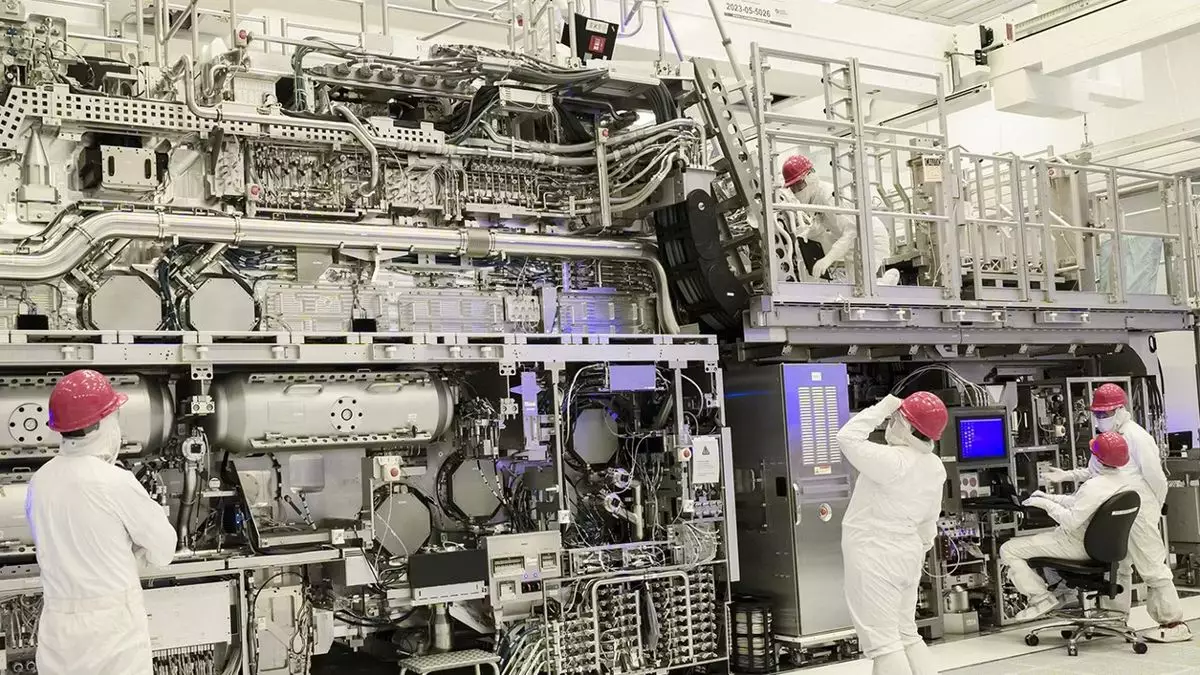

Intel touts some significant advancements with the 18A chip node, including claims of improved performance per watt, increased chip density, and groundbreaking backside-power delivery technologies. Specifically, this node is said to bring an impressive 15% enhancement in performance efficiency and 30% increased chip density when juxtaposed against Intel 3.

Diving deeper into the technical claims reveals apparent contradictions. While Intel asserts that the 18A node provides SRAM density on par with TSMC’s N2 node, there’s commentary in the industry about the overall limitations of the 18A chip. Industry insiders note that despite claims of innovative power delivery, Intel’s offering may provide less overall logic density compared to TSMC’s N3 and upcoming N2 nodes, generating a conversation about whether Intel can truly match or exceed TSMC’s prowess in process engineering.

The battle between Intel and TSMC is critical for the semiconductor landscape. With TSMC holding a commanding lead in chip manufacturing, Intel’s new 18A node is crucial for the company’s credibility and competitive relevance. If Intel can deliver on its promises of innovative architecture and improved power delivery mechanisms, it would allow the company to reclaim some market space in the computing realm where it has struggled against the niche dominance of TSMC.

However, history has not always favored Intel in the volatile silicon sphere, where competition spurs innovation but also is fraught with risk. If the promised technological improvements do not translate into viable commercial products by their self-imposed timelines, it could spell further troubles—both financially and reputationally—for Intel. After all, CEO Pat Gelsinger has publicly stated that he has “bet the whole company on 18A,” raising the stakes even higher.

Ultimately, whether 18A lives up to the lofty claims made by Intel remains to be seen. The stakes of this node are heightened, not only for Intel but for the general PC market, which needs diverse competition to drive innovation and keep costs from soaring. As we look toward the next couple of years, there is hope that Intel’s 18A will serve as a turning point, provided it can overcome the shadows of doubt that linger around its recent production delays and broader strategic challenges. The landscape is precarious, and while optimism abounds, prudence remains a wise companion in gauging Intel’s future trajectory.