Intel’s recent decision to sell off 51% of its stake in Altera to Silver Lake marks a pivotal moment in the semiconductor landscape, one that underscores the evolving dynamics within the technology sector. The offloading of this significant share highlights not just a financial maneuver but a larger strategic vision that Intel appears to be embracing as it seeks to refocus on its core competencies.

The Historical Trajectory of Intel and Altera

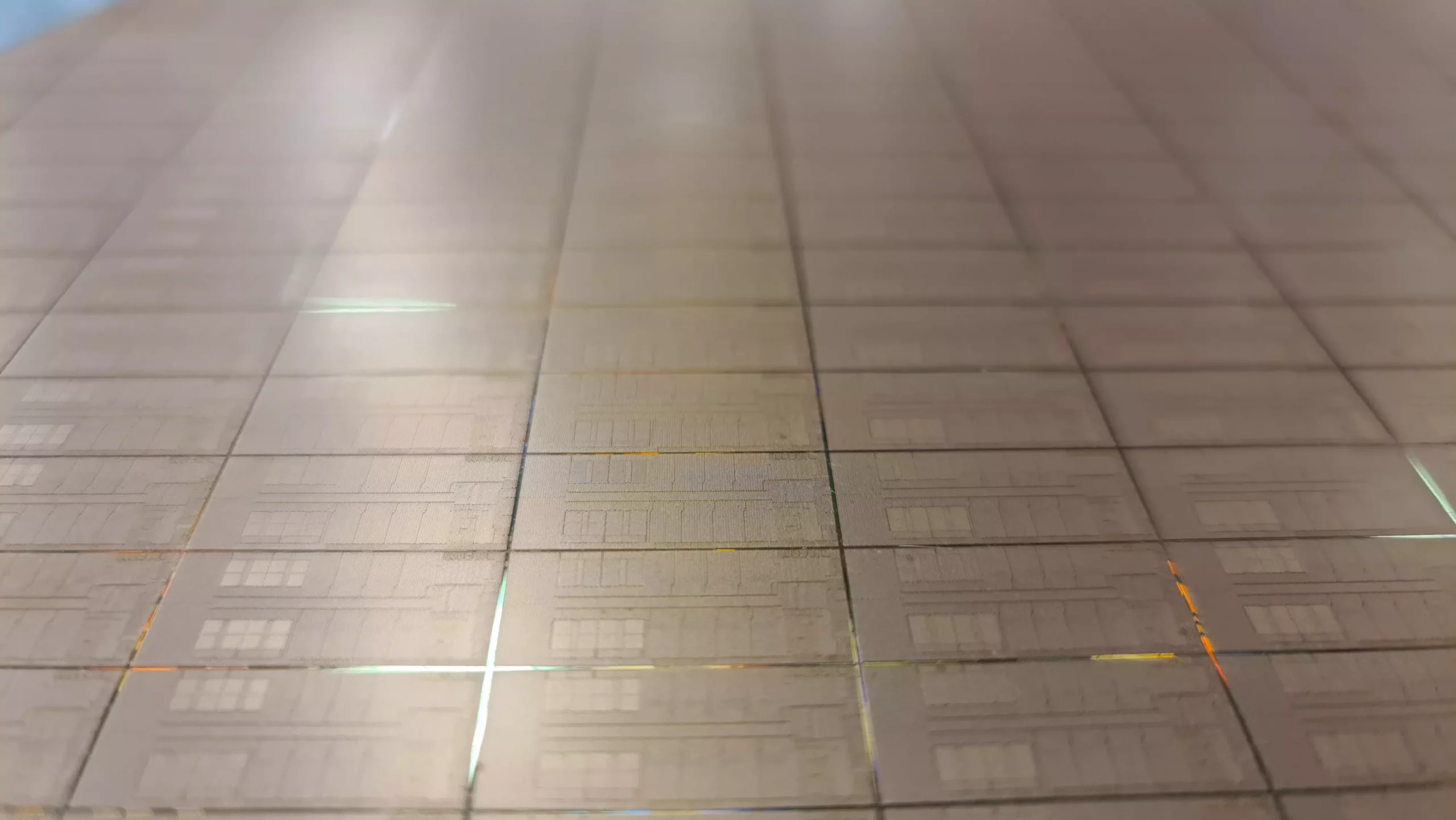

The relationship between Intel and Altera is rich in collaboration, dating back to their numerous joint ventures prior to Intel’s acquisition of Altera in 2015 for an impressive $16.7 billion. Altera specialized in programmable logic devices, effectively carving out a niche that complements Intel’s broad range of processing products. As the years progressed, Altera came to be seen as a crucial extension of Intel, primarily known for its Field Programmable Gate Arrays (FPGAs). These devices have become indispensable across a spectrum of applications, from telecommunications to consumer electronics.

However, the 2015 acquisition, while initially celebrated, might have contained within it the seeds of a precarious dependency. The drastic drop in Altera’s valuation with the recent deal — now pegged at $8.75 billion — symbolizes not merely a decline in perceived value but also raises questions about growth trajectories in a post-acquisition landscape. This is especially noteworthy considering that a massive investment was made just eight years prior.

Implications of the Silver Lake Deal

Intel’s move to part with a majority stake signifies a nuanced shift in its corporate philosophy. Retaining 49% of Altera allows Intel to maintain a significant influence, even as it steps back from day-to-day management — a balancing act that might allow both companies to thrive. The official narrative from Intel emphasizes the intent to reinvest focus on its core product lines, an assertion that resonates amid a time when semiconductor companies face fierce competition and growing demand for advanced technologies.

Silver Lake, an investment firm with an impressive portfolio, is likely banking on its ability to leverage Altera’s capabilities while steering it towards innovative solutions in a rapidly diversifying market. The notion that Silver Lake may take Altera further into successful technology terrain — possibly even to growth areas that were previously uncharted — brings an air of expectation to the industry. It signals an acknowledgment that independent expertise can sometimes pave the way for advancements that would be more challenging under a corporate umbrella.

The Future of Altera: A Fork in the Road

As Altera transitions into this new phase, the stakes are high. Potential exists for the company to become a highly autonomous entity, but the degree of independence it achieves will be contingent on Intel’s willingness to step back. With the recent announcement of Raghib Hussain as CEO, who has a history of success at Marvell, there is reason for optimism. However, Hussain’s ability to navigate the complexities of a partly-owned company in a turbulent tech environment will be critical in determining Altera’s future trajectory.

Altera’s evolution into what could be considered the largest technically independent company of its kind introduces an interesting paradigm for the semiconductor industry at large. The question looms: will Altera flourish autonomously, or will Intel’s retained influence still shape its path? An era of aggressive competition requiring agility, innovation, and rapid adaptation could set the stage for unprecedented developments, either by virtue of residing within Intel’s orbit or through newfound independence.

In sum, Intel’s decision regarding Altera serves as a lens through which to view the broader implications for the tech industry. It reflects a strategic realignment amid a rapidly changing landscape, characterized by both challenges and opportunities. As technology firms grapple with shifting needs and innovations, the future of independent enterprises like Altera may redefine success in the sector. It’s a market to keep an eye on, filled with potential shifts that could resonate well beyond the confines of semiconductor technologies.